Electrical Power Industry Logistics Success with 9% Freight Cost Reduction and 100% Visibility Using SuperProcure TMS

Case Study Electrical Power Industry Logistics Success with 9% Freight Cost Reduction and 100% Visibility

Case Study Electrical Power Industry Logistics Success with 9% Freight Cost Reduction and 100% Visibility

Table of Content : In our last blog, we talked about the five capabilities that actually matter in

The Indian Transportation industry is continually growing at a CAGR of 15%, with over 7 Million goods vehicles moving around the country. The freight volume has reached 1325 billion ton-km, which should double by 2025. The Indian economy spends almost 14% of its GDP on transportation and logistics, whereas developed countries spend 6-8% on total logistics costs.

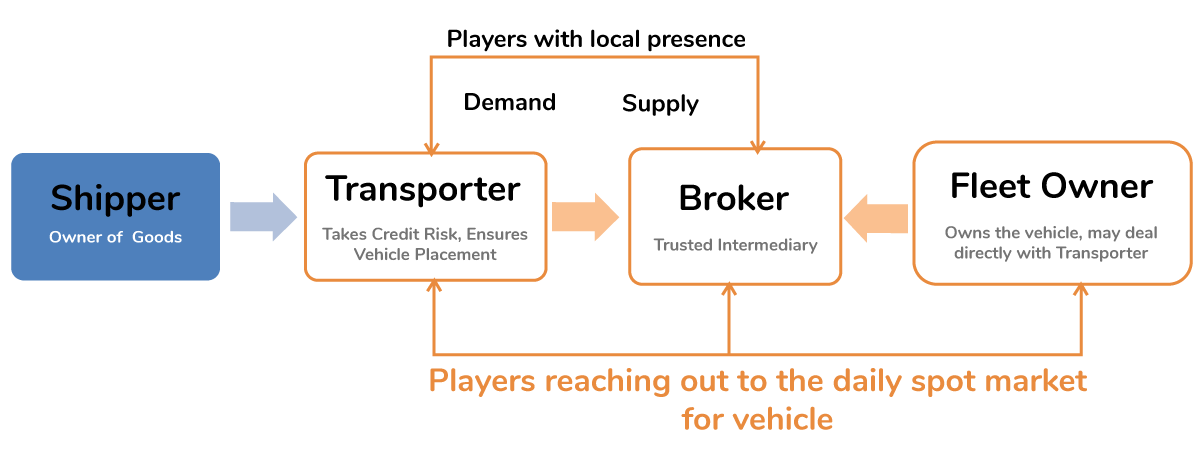

By nature, the Indian transportation industry remains heavily fragmented, unorganized, and rough. To better understand the issues in the industry, let us understand how the day-to-day operations go about and who the key stakeholders are. In the trucking industry, the spot market plays a pivotal role in deciding the freight charges and who is supposed to service a truckload. No matter how big or small a transporter/broker/fleet owner is, one has to reach out to the spot market (colloquially known as Mandi) to fulfill daily transportation requirements.

The infographic below clearly explains the working of the spot market.

The shipper is the primary owner of the goods, who needs them to be shipped from a location to the destination. At times the goods shipped might have multiple loading and unloading points. A shipper is a retailer, manufacturer, distributor, or some other firm that needs to move goods regularly, like ITC, Asian Paints, Patanjali, Tata Steel, and others.

The transporter takes the risk (financial/credit) of shipping the goods, and it is his responsibility to place the vehicles at the loading point, ensure that the necessary paperwork is done, pay the advance money to the vehicle supplier so that the goods can be shipped. Transporters typically have to pay 80-90% of the charges in advance and the remaining balance payment on the receipt of the proof of delivery, and they cannot raise an invoice to the shipper unless they receive a proof-of-delivery, which typically 2-3 weeks from the day the goods are delivered. Once the invoice is submitted, the shipper normally takes 30-60 days to make the payment. So, the role of the transporter is heavily capital-dependent.

As the name sounds, the broker is a trusted “local” liaison who heads the supply side. The broker exists so that a vehicle can be re-routed back to its origin. If anything goes wrong with the vehicle during the transit period, it is the broker’s responsibility to ensure that the vehicle is replaced and the goods are shipped. In India, typically, this is a one-man shop that places anywhere between 5-100 vehicles on a day-to-day basis. Broker exists because it’s impossible for the transporter/shipper to transact directly with the fleet owner as he is not present locally.

He is the owner of the vehicle, and his primary goal is to ensure maximum utilization of the vehicle. For every day the vehicle is in-placed, he has to bear the cost. Fleet owners, at times, approach the transporter directly. However, in such cases, there is a guarantee of a minimum load from the demand side, and a strict KYC is done by the transporter. The fleet owners are heavily fragmented in India, with more than 80% of the fleets owned by people having less than ten vehicles, which gives birth to the intermediaries.

Assigning a load to a vehicle is not an easy process, as there are multiple entities involved in the entire transaction, and multiple activities happen in the background before the goods can be dispatched.

The nature of the spot market is such that it is heavily time-bounded – a shipper requires a vehicle urgently and reaches out to the transporter, whom in-turn reaches out to the suppliers in the mandi (brokers and fleet owners) to get the current rates, and since these transactions are bounded by time, this leads to huge price volatility as the demand and supply of goods and vehicles keep changing in a rapid manner.

In India, there are multi modes of agreements carried out by shippers to manage dispatch operations. The common approximation in practice is that in India, contractual relationships cover around 30-40% of the market, whereas spot consists of the remainder. Shippers typically use a combination of multiple types of relationships to manage their truckload operations, i.e., fixed/variable contracts across one or multiple routes, spot arrangements, and at times, their private fleet too (especially for certain kinds of items and for certain fixed lanes)

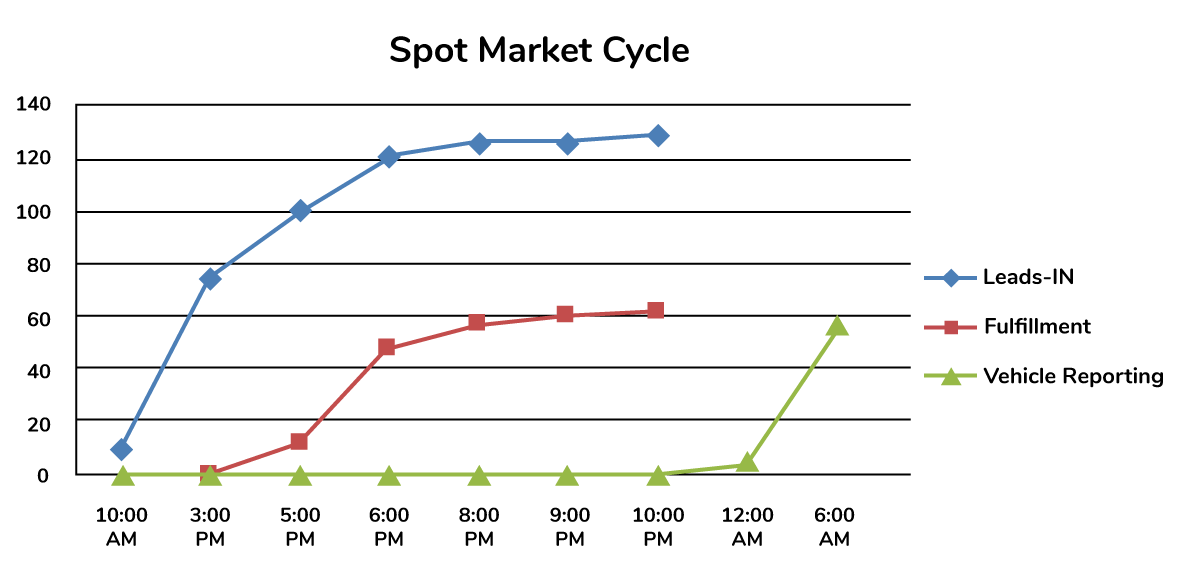

Typically, in a transport company, leads start queuing up at the beginning of the day, i.e., the shippers confirm the requirement of truckload movement for the next day. At the same time, the vehicle suppliers get a true check on the inventory of vehicles available as most of the vehicles are done with their unloading and are ready for their next trip. Parallels can be drawn between the spot market and the trading floor at the stock market, i.e., they are both governed by demand and supply. Typically, by late afternoon the vehicle availability is made open by the suppliers, and the assignment starts. However, the suppliers hold their cards close to their chest, and the assignment does not happen until after a fair round of negotiation on the daily pricing happens. Something as innocuous as multiple phone calls for a specific route can drive the price up drastically as it throws an indication that the demand is high.

All the above activities take place with minimalistic or no technology. At-most emails are used to communicate the prices to shippers and confirmation by them. Because the market is large, fragmented, and unorganized, the truckload assignment has been subjected to a large number of first-generation procurement mechanisms.

Once the load-vehicle assignment is done, the transporters typically have a final check to ensure that the drivers understand the loading point correctly and are on route. The vehicles typically report at the loading site post-midnight so that they can avoid the local traffic. The subsequent day the vehicles are loaded, the documentation process is completed, and the transporters pay out the advance money to the vehicle suppliers. In this trade, 80-90% of the money is paid out to the vehicle supplier as advance, and the rest is paid out on delivery of the goods.

There have been numerous attempts made to build a transport/freight exchange that can recreate the spot market in the online world. Moreover, a lot of shippers have tried to move to electronic modes of managing their truckload operations. However, a handful has been able to move successfully in India. A lot of shippers have used negotiation platforms to assign lanes/routes/volumes to transporters. However, even though the shippers have chosen the online path, the transporters, brokers, and fleet owners have to come down to the spot market to fulfill the daily loads (even though the rates are frozen and are part of a contractual agreement).

Technology can play a significant role in bringing the spot markets online. However, the following aspects need to be addressed carefully –

I strongly believe that technology has a long and major role to play in this field and especially in the Indian context. There is a flurry of start-ups in this space that are attacking the problems from different ends and are trying to make some dents in the landscape and smoothen the operations. However, this is a long marathon and a huge market opportunity, with vast gaps and scope for improvement. Only time will tell whether a reliable and robust transport exchange can be built over the next 5-10 years.

It makes sense to turn to the logistics and supply chain management solution we currently have to maximize your buying power.

Varun Biyani is the Co-Founder and CTO of SuperProcure. Varun has a Master’s degree from Carnegie Mellon University and more than 12 years of experience in building systems in the Logistics space, both in the domestic and international arena.

Subscribe to our blog for the latest news and updates

Ensure your company’s data is completely secure and compliant with the latest regulatory standards

5/5

4.5/5

5/5

4.5/5

Solutions

Industry

Real Time Freight Sourcing And Collaboration Platform

Unit 3B, 4 Bakul Bagan Row, Lansdowne Market. Kolkata- 700025, India

Share us the details to connect to a relevant team member.